Signup an absolute class, towards brand detection from a fortune 400 providers who may have held it’s place in team over 100 Many years!

Driven because of the home town opinions and you may an union to help you getting in control and you can taking good care of one another, Shared out of Omaha Home loan can be obtained to the advantageous asset of the customers. Using this sophisticated profile, there is certainly your potential customers getting so much more responsive due to our very own well branded name

Mutual away from Omaha Opposite Mortgage employs an informed employees away from knowledgeable Financial Bankers which have an operations party which is first rate. Our company is here to address and you will solve one of the most significant demands up against the little one Boomer Generation today… Financial Preparedness because of their advancing years many years. We have been dedicated to training Retirees and their family into worth of an item that was developed by the fresh You.S. regulators throughout the President Reagan’s title when you look at the Place of work. The house Collateral Conversion process Home loan (HECM) was designed to make use of the equity yourself because the an excellent means to help a peaceful and you may safe change in order to your old-age decades. Of many Economic Advisors are now actually realizing the value of the merchandise as one of multiple secret economic considered systems during the advancing years. Our team was invested in our very own customers, and then we is actually right here to help on the timeline…maybe not ours. All of our Dedication to the customers are a beneficial techniques depending a reputable, moral and open talk.

Professionals is Medical, Dental care, and you may Vision insurance rates, company paid off coverage, 401K with a good company fits and extra gurus eg 100 % free Legal counsel and an employee Mortgage Program

Brand new Hero Creativity System are an exercise system to have masters lookin to go into an advisable job regarding Contrary Home loan Industry. The applying is created for the profits and you may is sold with a high quantity of knowledge, assistance, and you may hands-into the courses in order to find out the company and create a winning Opposite Mortgage community.

- Developing a system off Real estate professionals, Economic Advisors, Developers, New home Conversion Consultants, Lenders, Home loan Officers or other Economic Professionals to educate all of them on benefits of Opposite Mortgages as well as how leverage Homes Wealth Selection normally benefit their customers

- Providing retirees pursue and you may fulfill its old-age needs by educating them in regards to the advantages of leveraging your house Equity in their house

- Seeing a collaborative ecosystem where i enjoy for each other people’s achievement

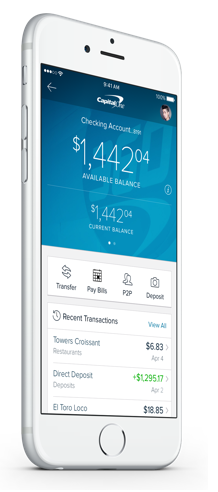

- Utilizing cutting edge technical to remain top from notice together with your people and you will tips people

- Choosing lingering elite group innovation degree to help you deepen your talent and improve your own increases

- Entry to interior prospects

- Limitless possibility of monetary growth with a beneficial twelve-week ensure, and additionally an advantage to help you get become

Mutual out-of Omaha Mortgage are a full service home loan company giving each other Send and you will Reverse Mortgage points along with a complete distinctive line of domestic financial, refinancing, specialty, and you will HECM loans

In the Common of Omaha Contrary Home loan, Mortgage Officers was taught to pay attention and construct relationship, plus insights and you may evaluating an entire economic situations from our consumers. All of our goal should be to provide the most appropriate financial methods to fulfill per consumer’s specific needs.

- Are energetic and you can outgoing, with higher level telecommunications feel and capacity to be persuasive, with an excellent reputation and integrity.

- Connects easily that have people and generates relationship that have prospective clients

Mutual out-of Omaha is actually tons of money 3 hundred Organization. Common of Omaha Mortgage originates from home town thinking and good commitment to are responsible and caring for each other. We exists on the advantageous asset of the users and you can group. We provide an extensive compensation package. I implement a knowledgeable employees out-of educated Financing Officials and you may Mortgage Bankers having a surgery cluster which is second to none. When you find yourself shopping for joining a team one to produces out-of in this and you may works together into the a common goal of permitting customers with regards to financial demands we may like to pay attention to away from you!