Owning a home within the Canada try an objective of several newbies dream off finding. As opposed to other shorter assets, to invest in a home otherwise property comes to a lot of financial capital.

As a novice, you’ve got of a lot questions relating to the entire process of capital your first domestic from inside the Canada. In this post, we’re going to walk you through the basics of taking a mortgage, description the fresh new invisible will set you back, and display specific budgeting tips so you’re able to purchase a home.

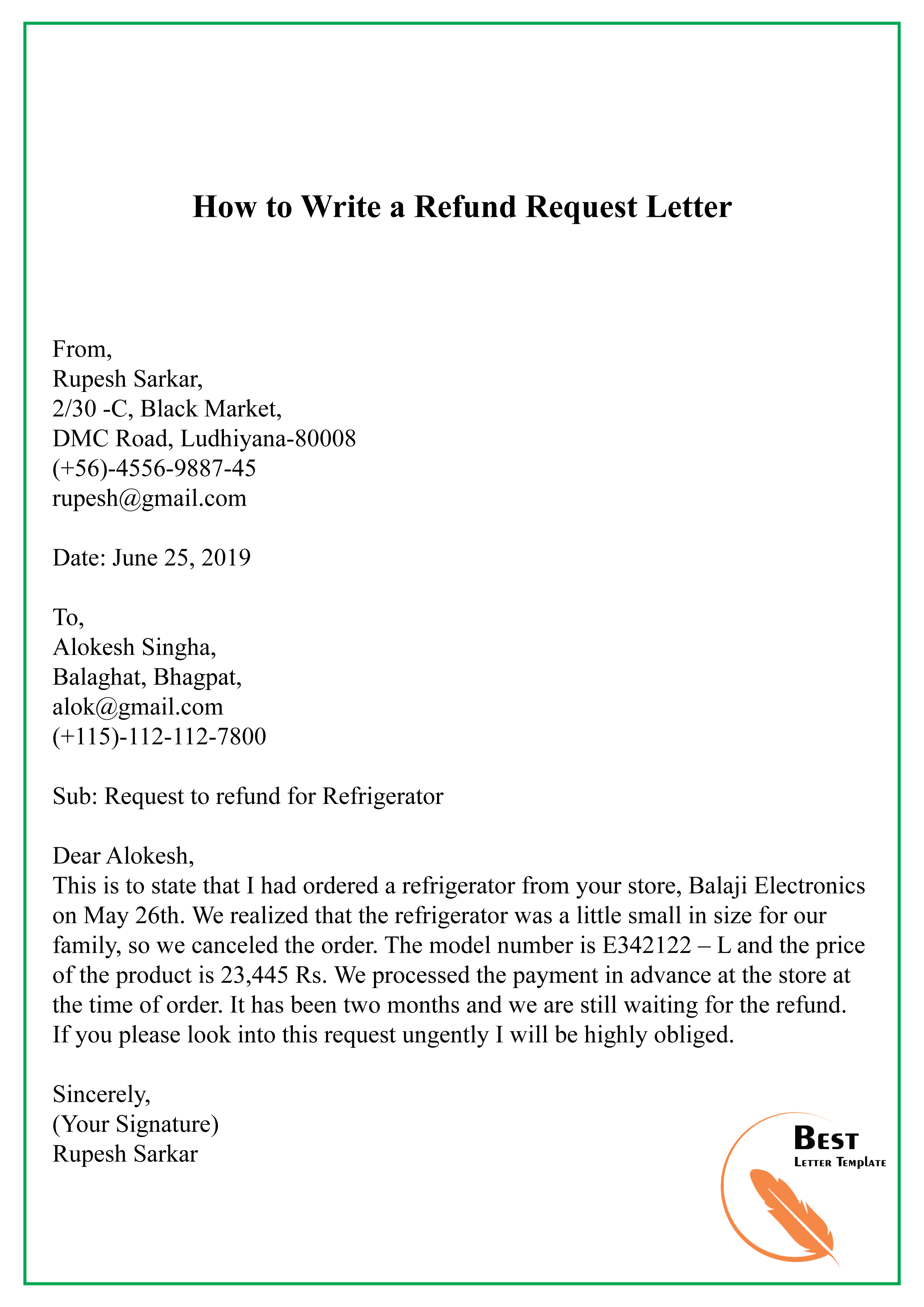

1. Reach out to home financing specialist

The first step within the to invest in a home otherwise people possessions within the Canada is always to contact a lending institution otherwise financial one to really does mortgages. They’ll certainly be able to guide you given your own unique problem.

- A down-payment: Here is the dollars that you would purchase the purchase of your home or property. When you look at the Canada you will find the very least deposit that is required and number depends on the price of our home you is to get. Just be sure to spend five percent of your first $500,000 of the home rates, 10 % of the house pricing past $500,000 or over to help you $1,000,000, and you will 20 percent for all the kept costs significantly more than $step 1,000,000. Therefore like, minimal downpayment necessary for a house really worth $700,000 could well be $25,000 (5 per cent of basic $five-hundred,000) + $20,000 (ten per cent of leftover $two hundred,000) = $45,000.

- Credit rating: Individuals are usually anticipated to promote Canadian credit score, hence most newcomer don’t possess upon arrival inside the Canada. Although not, particular finance companies, such as for example RBC, bring home financing options you to satisfy newcomers demands. You will be qualified to receive home financing, also without Canadian credit rating, when you have international earnings, investment income, or stable work when you look at the Canada. Keep in mind that strengthening good credit background needs time to work ; thus, get started once you proceed to Canada.

- Assurance away from mortgage payment: The financial institution otherwise bank commonly generally measure the setting as a result of that you can pay the loan. Current resources of earnings (with a beneficial 90-date record) as well as your possibility to earn an income inside Canada are pulled into account if you’re granting a mortgage application.

dos. Rating pre-recognized and you will cover your home

Second, it is recommended https://clickcashadvance.com/payday-loans-me/ to obtain pre-accepted having a mortgage . Which have pre-acceptance indicates that you have met the fundamental qualifications requirements (deposit, credit score, and you may earnings) for finding home financing. Within the pre-acceptance processes, the lending company will let you know the restrict cost and you may outline the fresh downpayment.

step 3. Complete financial app after looking property otherwise possessions you want to shop for

Should you have their financial app pre-acknowledged, the last recognition techniques could take doing weekly. But there’s no need to care because your app could well be prioritized in order to satisfy the financing condition day mentioned in your buy offer.

For individuals who did not have pre-approval, so long as you can give most of the expected papers in a timely manner, it could however do the exact same time for you feel acknowledged. Pre-approvals is actually recommended before shopping for property/assets to stop one decelerate inside the finishing your purchase in order to make certain you have enough time to get every expected files.

5. Paying off the mortgage

Extremely individuals put up a mortgage that’s paid off more than a twenty-five-year time frame. Constantly, there is the power to generate extra costs this will help to treat amortization and the duration of the borrowed funds.

If you opt to offer your house/assets in advance of you’ve done settling the mortgage, currency won throughout the purchases could well be regularly pay your whole home loan, and any extra number will be repaid to you personally due to the fact security of the home.

Keeping up with financial criteria whenever you are buying a property are going to be challenging. Once the an initial-big date family-visitors inside the Canada, make sure that your financial advisor or financial specialist practical knowledge, educated, and is fully familiar with the house buying process. And once you have located your house otherwise possessions we want to purchase, make sure you iron aside all the details which have a dependable monetary advisor given that you are in they into the overall.

This article also provides general recommendations simply and that is perhaps not suggested as the legal, monetary or any other expert advice. A professional mentor are going to be consulted about your particular condition. When you’re pointers exhibited is believed getting informative and you will newest, their precision isnt guaranteed and it shouldn’t be considered because the a whole study of victims discussed. The expressions off viewpoint mirror new judgment of your journalist(s) by this new time regarding book and are susceptible to changes. No acceptance of any businesses otherwise its recommendations, views, information, products or services is expressly given or implied from the Regal Financial from Canada otherwise its affiliates.