Contents:

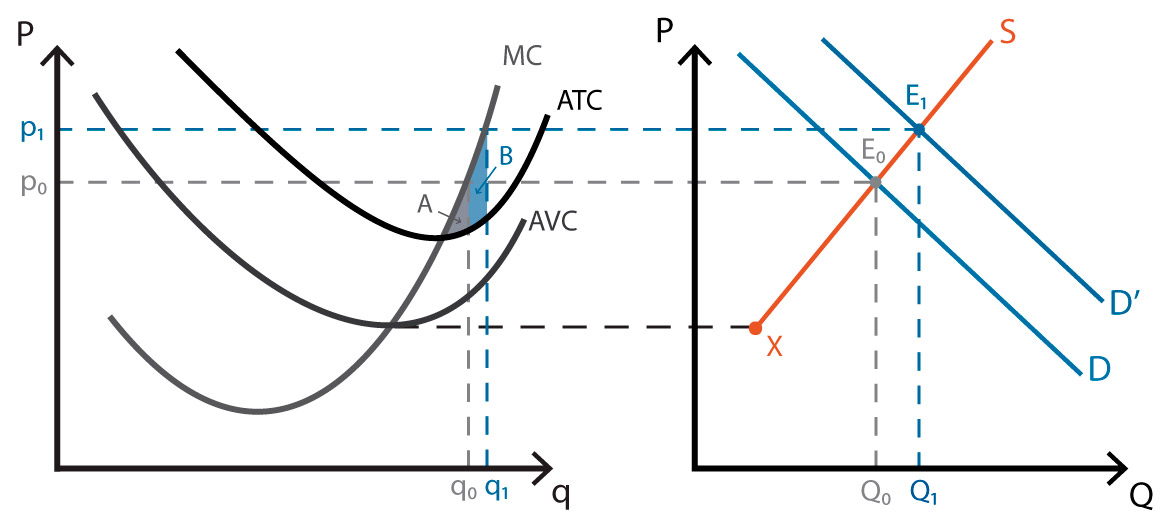

If the government desires to have interaction in expansionary policy to encourage progress, it’ll improve government spending and reduce taxes. A discount in taxes will leave more disposable revenue and trigger consumption and financial savings to extend, additionally shifting the mixture demand curve to the right. An improve in authorities spending combined with a discount in taxes will, unsurprisingly, also shift the AD curve to the proper. Fiscal policy means the use of taxation and public expenditure by the government for stabilization or growth of the economy. The unbalanced overdependence on monetary policy is now showing itself up to be less and less effective in generating recovery.

- A danger of a temporary fiscal growth is it becomes everlasting as a result of political stress.

- Decreasing government spending will create a contraction in job opportunities.

- While this may make sense in purely accounting terms , it makes a mockery of the economic distinction in such spending.

- Fiscal policy involves the government changing tax rates and levels of government spending to influence aggregate demand in the economy.

- Fiscal policy is how Congress and different elected officers influence the economic system using spending and taxation.

On the other hand, an increase in taxes means the government will eat more from your salary. Suppose the government starts spending a significant amount of money to build more hospitals, schools and to help the construction sector. From your salary, you will spend a portion of your money to buy things from your neighbourhood shopkeeper.

Both of these policies are meant to extend aggregate demand whereas contributing to deficits or drawing down of price range surpluses. The reverse of expansionary fiscal policy, contractionary fiscal coverage raises taxes and cuts spending. In times of recession, Keynesian economics means that increasing authorities spending and decreasing tax charges is one of the simplest ways to stimulate mixture demand.

Term & Policy

It is notable that fiscal policy in a developed country is preoccupied with the problems of business cycle-boom and depression. India’s response to the economic downturn due to Covid19 is interesting. The AtmaNirbhar Package that the central government announced includes measures that will increase liquidity in the market and improve the job situation .

Also, there is a high demand for goods and services, and organizations gear ready for rising production in terms of quality and quantity. Higher utilization will raise total interest and this should prompt higher financial development.This infusion of money into the economy can likewise cause a positive multiplier impact. Expanded government spending, through, regularly on open works, to boost the overall level of employment.

Free Trade Agreements Signed by India| CEPA| CECA

But the real issue is, how have these processes played out in practice, in the recent Indian experience? Here, the obvious, but under-noticed, point is thatlarger than declared fiscal deficits have had neither of these anticipated adverse effects. Not only have the fiscal targets promised under the FRBMA not been met, but the actual fiscal deficits have been significantly greater than those that have been declared.

These two insurance policies are used in various mixtures to direct a rustic’s financial objectives. Here’s a take a look at how fiscal coverage works, how it have to be monitored, and the way its implementation could have an effect on different individuals in an economic system. Since ‘fiscal coverage’ is talked about and ‘contrasted’ with, I took it as ‘financial policy’ of Government. If you type fiscal coverage in Google – it auto-completes to say ‘Fiscal coverage is the means by which a authorities adjusts its spending levels and tax charges to watch and influence a nation’s economy. It is the sister technique to financial policy via which a central financial institution influences a nation’s cash provide’.

SEBI: Reluctant Market Regulator Needs To Press the Reset Button

While investors around the world wait breathlessly for the next stimulus from governments in developed countries and emerging markets alike, the reality is that government policy options are quite limited. They cannot undertake a fiscal or monetary policy to make things better without making other things worse. European stimulus wouldn’t ignite inflation, but it would exacerbate sovereign debt problems. Most emerging markets don’t have the debt problems, but they do have severe inflation, which has to be tamed. The paradox is that the one policy that politicians will not follow is the one policy that would actually work; the path of true reform.

A danger of a temporary fiscal growth is it becomes everlasting as a result of political stress. It is distinct from monetary policy, which is normally set by a central bank and focuses on interest rates and the money supply. Fiscal coverage is often used in mixture withmonetary coverage, which, in the United States, is ready by the Federal Reserve to affect the course of the economy and meet economic goals.

As a result of the recent elections in France and Greece the latest mantra among European leaders is that their policies have to change from austerity to growth. One has to wonder what exactly do they expect to use to stimulate growth? One would be to try and stimulate their economies using fiscal policies. They could either cut taxes to encourage people to spend or the governments could increase spending on government programs.

Why it’s time for the US Army to divest Iron Dome – Breaking Defense

Why it’s time for the US Army to divest Iron Dome.

Posted: Mon, 27 Mar 2023 15:02:16 GMT [source]

Second, lots of the fascinating options of computerized stabilisers are nearly inconceivable to replicate by discretionary reactions of policy makers. Fiscal coverage may also dictate a lower in authorities spending and thereby lower the money in circulation. Of course, the potential negative effects of such a policy, in the long term, might be a sluggish economy and high unemployment levels.

A liquidity lure happens when interest rate cuts are inadequate as a demand booster as banks don’t want to lend and the shoppers are reluctant to extend spending as a result of adverse expectations for the economic system. In this way, the federal government could deem it necessary to halt or deter economic growth if inflation brought on by elevated provide and demand of cash will get out of hand. Fiscal policy is what the government employs to influence and balance the economy, utilizing taxes and spending to perform this. Basically, fiscal coverage intercedes within the business cycle by counteracting points in an attempt to ascertain a more healthy economic system, and makes use of two tools – taxes and spending – to accomplish this.

Direct taxation at times become an instrument of limited applicability, as the vast majority of the people are not covered by it. Further, when the total tax revenue forms a smaller portion of the national income, fiscal measures will not step up the sagging economy requiring massive help. Monetary policy involves changing the interest rate and influencing the money supply. Fiscal policy involves the government changing tax rates and levels of government spending to influence aggregate demand in the economy. Fiscal drag is an economic term whereby inflation or income growth moves taxpayers into higher tax brackets. This in effect increases government tax revenue without actually increasing tax rates.

Fiscal policy as ineffective anti-cyclical measure

Luxury brands including Hermès, Hugo Boss and Tommy Hilfiger Chanel, Armani, Christian Dior, Zara and Burberry have been attacked as substandard. Wal-Mart in Chongqing found itself the scapegoat for high pork what are the limitations of fiscal policys, while Coke, Heinz, Procter & Gamble General Mills, Lipton Teas, Colgate-Palmolive all have been accused of selling adulterated products. It was hoped that the Union Budget 2018–19 would take measures to address some of these concerns but these expectations have been belied. Budget 2018–19, possibly with an eye on elections, has made grand announcements instead of taking hard decisions and making adequate allocations towards key sectors of the economy. Deadly and frightening as it appears, it is still too early to estimate the severity of India’s Covid-19 second wave. Unlike the transatlantic countries where it appears to have peaked, India’s second wave is still trending upwards.

This is evident in growth of high frequency indicators like PMI Manufacturing, index of eight core industries, E-way bills, Kharif sowing, power consumption, railway freight, cargo traffic and passenger vehicle sales. But the main problem for China and other emerging markets in learning the art of marketing is the protection of the brands themselves. The Chinese governments, usually local governments in trying to protect home grown industries, have been ruthless in slandering foreign brands.

- If the government is raising its expenditure, it will be indicated by a higher deficit in the budget.

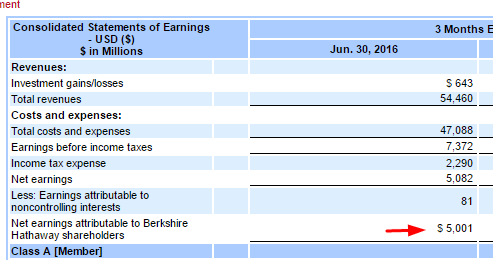

- US government also made significant steps as part of their fiscal policy to control sub-prime crisis and recession.

- Monetary policy is the decisions a authorities makes in regards to the cash supply and interest rates.

- In flip, this will likely have adverse results on the economic system’s lengthy-run progress prospects as high taxes reduce the incentives to work, invest and innovate.

- There are two types of expansionary policy- Monetary policy and Fiscal policy.

https://1investing.in/ development ensuing from an increase in mixture demand causes price ranges to rise. The authorities uses its own fiscal coverage toolkit, like a health care provider, to manage fiscal policy tools – like government spending, taxes and transfer funds – to help strengthen mixture demand when it is weak. On the opposite hand, when the financial system is overheating by rising beyond its capacity, fiscal coverage does the other and slows down financial growth to handle the problem of inflation. Similar to fiscal policy, it operates to both stimulate or curtail the economic system.

In pursuing expansionary policy, the federal government increases spending, reduces taxes, or does a mix of the two. Since government spending is one of the elements of combination demand, an increase in government spending will shift the demand curve to the right. Fiscal policy is based on the theories of British economist John Maynard Keynes.