There are a lot of strange names one to pop up inside the conversations throughout the lenders and also the home loan business. Maybe you have wondered who Ginnie Mae is actually and you can what she has to do with home loans. Freddie Mac computer otherwise Federal national mortgage association are brought up seem to. Are they about Ginnie Mae? Right after which you will find Irle. He could be fairly popular. He sounds Uk, proper? Such names are common so you’re able to home loan positives, however, commonly suggest absolutely nothing into the mediocre consumer. Ginnie Mae, Irle, Freddie Mac, and Federal national mortgage association are an excellent family in a way. They all are acronyms connected with different mortgage loan entities and programs:

- Ginnie Mae is the Regulators Federal Home loan Organization (GNMA)

- Federal national mortgage association is the Fannie mae (FNMA)

- Freddie Mac computer is actually Federal Mortgage Financial Corporation (FHLMC)

- Irle ‘s the Interest rate Cures Refinance loan (IRRRL)

Ginnie Mae falls from inside the Department from Homes and you will Urban Invention (HUD). The origins go dating back the great Anxiety, and it also is present to promote owning a home. Ginnie Mae ‘s the first resource arm getting authorities finance. Va money try a variety of government financing and generally are guaranteed from the U.S Company away from Experts Points (VA). An IRRRL is actually another Virtual assistant home mortgage refinance loan.

Virtual assistant Home loan Program

This new pri should be to let eligible veterans fund the acquisition away from belongings having positive loan terminology and also at aggressive rates of interest. The word veteran has effective duty Servicemembers, Pros, Reservists, Federal Protect participants, and you may particular enduring partners.

A finances-Away Home mortgage refinance loan can be used to pay back obligations, finance university, build home improvements, otherwise re-finance a low-Virtual assistant mortgage to your a beneficial Virtual assistant home loan. Veterans also provide entry to an IRRRL, a smooth refinance system.

Borrowers never contact Ginnie Mae or even the Va if they are curious from inside the good Va loan. Like other lenders, they are over courtesy individual lenders, such as for instance banking institutions and you will home loan businesses.

Benefits of Va Mortgages

- All the way down rates of interest

- Zero down payment

- No home loan insurance coverage

- Lower fico scores

- Closing rates constraints

1. Lower Rates

Brand new Va guarantees a fraction of for each and every Va financing, which make certain helps manage the financial institution from loss in the event your borrower fails to repay the borrowed funds. Due to the fact Virtual assistant fund offer quicker chance than other form of mortgage finance, lenders was comfortable providing a lesser interest rate. A lower life expectancy interest may benefit a borrower for the app process by allowing them to be eligible for a much bigger loan amount. Additionally make the borrower expenses less during the appeal across the longevity of the loan.

2. Zero Deposit

A Va loan doesn’t require a down payment so long as the newest deals rate will not surpass the brand new appraised value of the house or property. In contrast, loans Suffield Depot most other loan applications wanted a down-payment regarding from 3.5 per cent to 20%. To be able to funds 100 % of cost you will enable it to be a debtor to purchase a house in the course of time in contrast some other financing applications.

step three. No Home loan Insurance rates

Consumers are usually needed to buy mortgage insurance coverage if they try not to generate a 20% down-payment. Which insurance compensates the lender otherwise buyer in case the borrower will not result in the home loan repayments and financing goes in default. However, since a beneficial Va loan is secured, financial insurance policy is not essential and causes a discount getting the fresh new borrower.

cuatro. Straight down Credit scores

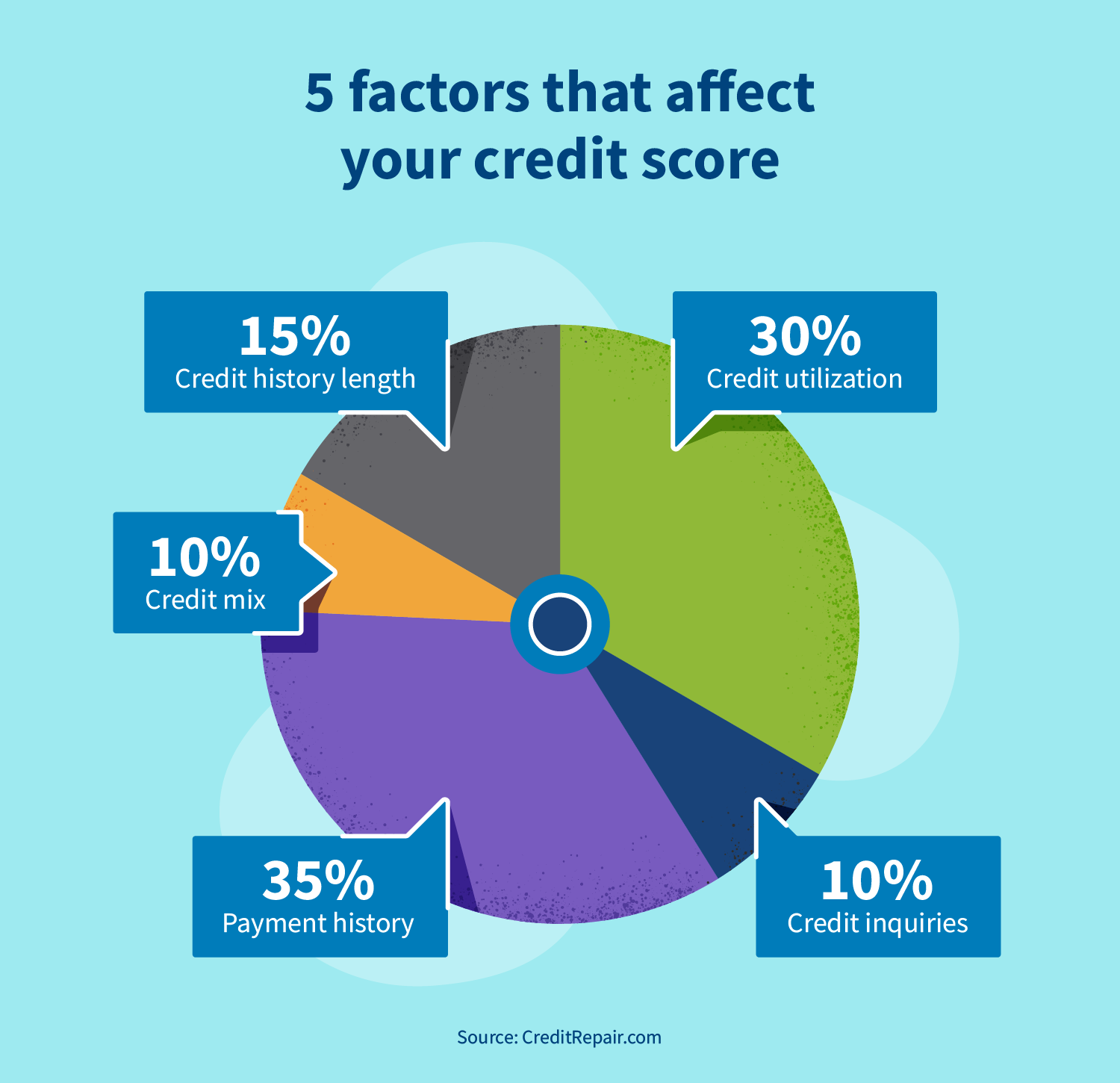

Credit scores try a fundamental piece of being qualified your household financing. A debtor that have a lower life expectancy credit rating is recognized as being a high exposure than a debtor having a high credit score. The new Virtual assistant will not put credit rating minimums for Va money. The minimums vary according to lender. Although not, because the a good Va mortgage are secured, new debtor can get a great deal more independence and result is tend to a lower credit history lowest than what could be acknowledged to possess other kinds of finance.