While you are considering to order a property, you’re probably picturing the recollections you are able to create on your new home, the great nearest and dearest meals and you may night hanging out with loved ones. Your ideas may well not initial stray into the terminology eg debt-to-income (DTI) ratio otherwise credit rating.

You happen to be a lot more familiar with terms and conditions such as because you undergo the loan process. In this article we are going to coverage everything you need to learn about DTI. Loan providers need to simply take an in-breadth look at the DTI proportion to make sure you do not bring continuously obligations. A high DTI proportion you will laws to help you lenders that your financial situation allows you to an effective riskier debtor on the potential to default in your mortgage loan.

We are going to walk through the fresh new vital matter of it portion: What’s obligations so you can money proportion? and also talk about ideas on how to assess personal debt-to-income proportion.

What exactly is Debt-to-Income or DTI Proportion?

Debt-in order to income ratio (DTI) pertains to calculating this new percentage of your debt financial obligation against your own month-to-month gross income. Put simply, the ratio compares your current debt towards income.

DTI Algorithm and you will Calculation

Exactly what monthly payments are part of your DTI proportion? These types of expense make reference to your fixed month-to-month costs. Monthly payments do not is payments you to definitely are different monthly, such as utility bills, energy, minimal mastercard payments owed or any other form of variable expense otherwise money.

Their DTI ratio computation is simply become repaired costs such as for example rent money, car loan money, alimony, youngster support, education loan money and other repaired payments.

Your disgusting monthly money, as well, refers to the amount you have made before any taxation or deductions score taken off your account. Discover more about simple tips to determine loans-to-earnings proportion here.

Debt-to-Income Proportion Instances

Why don’t we walk-through a quick illustration of how exactly to assess DTI. Let’s say there is the pursuing the repaired monthly costs:

- Education loan percentage: $500

- Rent: $800

- Alimony: $400

- Personal loan percentage: $five hundred

- Gross monthly income: $six,000

What makes DTI Important in Individual Funds and you can Loans?

The low your debt-to-income (DTI) ratio, the greater, since the loan providers make use of DTI so you’re able to determine their rates and conditions.

Sort of Financial obligation-to-Income Percentages

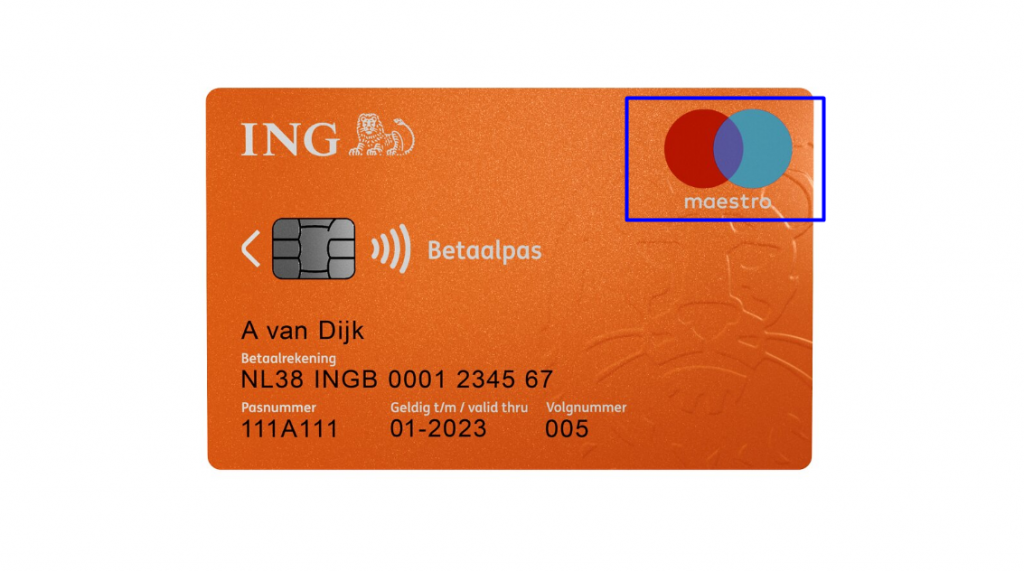

Lenders look at two types of percentages: front-prevent DTI ratio and you can straight back-avoid DTI proportion. Front-stop DTI is inspired by property expenditures separated by gross income. Back-end DTI, while doing so, arises from the newest portion of revenues spent on other debt brands, eg playing cards otherwise car and truck loans.

- Front-end DTI ratio: So you’re able to determine front-end DTI, sound right their expected housing expenditures (such as for instance mortgage payments, home loan insurance rates, etcetera.) and you may separate it by your gross monthly earnings to really get your front-prevent DTI ratio. Let’s say which you now have a good $dos,000 mortgage payment while bring in $six,000 30 days within the terrible monthly earnings. Within this example, your own side-stop DTI ratio would-be 33%.

- Back-avoid DTI proportion: You could potentially estimate straight back-stop DTI ratio adding to each other their month-to-month obligations costs and you can personal loans for bad credit TN dividing the sum of by the month-to-month income. Back-prevent DTI ratio turns out the newest analogy i went more prior to on this page: $six,000 ? $2,two hundred = DTI Ratio (37%).

What’s an effective Personal debt-to-Income Proportion?

It’s also possible to wonder on which DTI ratio fee you ought to point having. Let’s walk through an appropriate DTI percentages to own mortgage loans.

A good DTI Percentages getting Home loan (Exactly what do Lenders Need?)

You will need to select since lower off a beneficial DTI that one can. Lenders generally speaking like to see a DTI proportion away from 43% otherwise down, although this requisite utilizes the loan types of. Lenders look at your DTI proportion while they need to mortgage so you can individuals with less risk of defaulting to their financing.