As you can see from the above example, it’s difficult to determine whether a D/E ratio is “good” without looking at it in context. It’s clear that Restoration Hardware relies on debt to fund its operations to a much greater extent than Ethan Allen, though this is not necessarily a bad thing. Total liabilities are all of the debts the company owes to any outside entity. Determining whether a company’s ratio is good or bad means considering other factors in conjunction with the ratio.

Formula and Calculation of the D/E Ratio

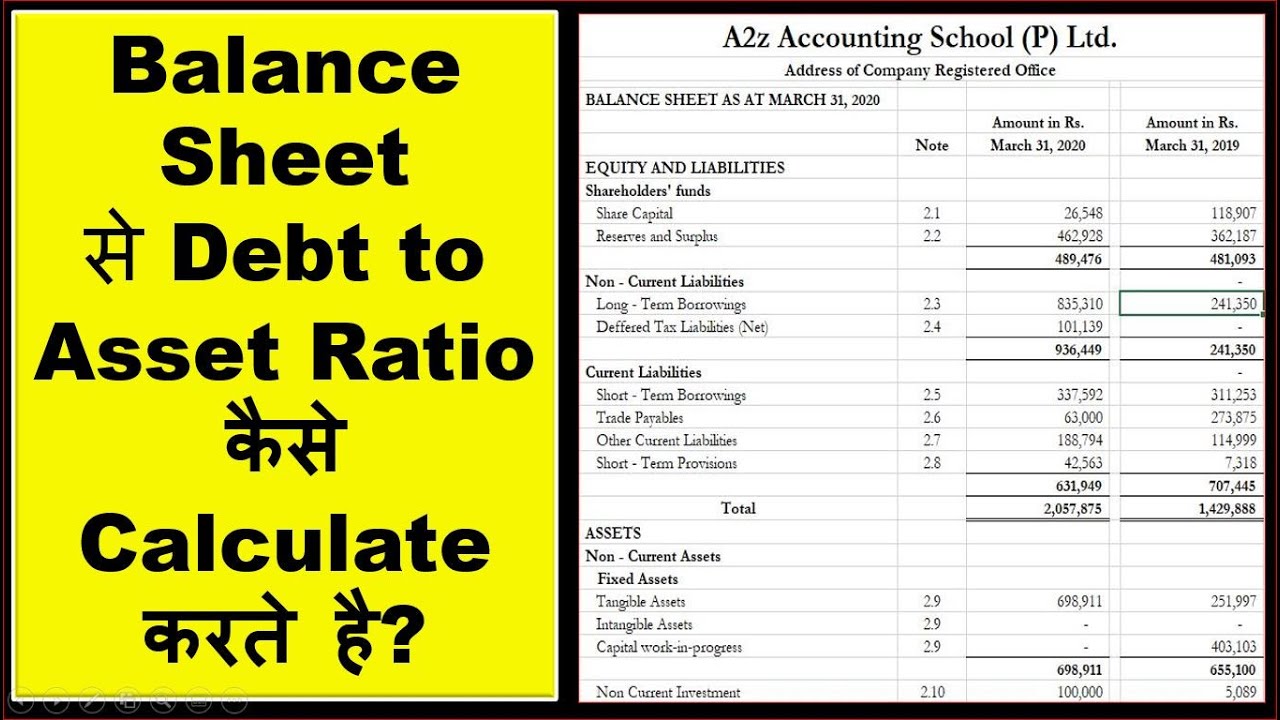

The D/E ratio of a company can be calculated by dividing its total liabilities by its total shareholder equity. Lenders and debt investors prefer lower D/E ratios as that implies there is less reliance on debt financing to fund operations – i.e. working capital requirements such as the purchase of inventory. Suppose a company carries $200 million in total debt and $100 million in shareholders’ equity per its balance sheet. If preferred stock appears on the debt side of the equation, a company’s debt-to-equity ratio may look riskier. Having to make high debt payments can leave companies with less cash on hand to pay for growth, which can also hurt the company and shareholders. And a high debt-to-equity ratio can limit a company’s access to borrowing, which could limit its ability to grow.

Current Ratio

The debt-to-equity ratio (D/E) is calculated by dividing the total debt balance by the total equity balance. Lenders and investors perceive borrowers funded primarily with equity (e.g. owners’ equity, outside equity raised, retained earnings) more favorably. In general, if a company’s D/E ratio is too high, that signals that the company is at risk of financial distress (i.e. at risk of being unable to meet required debt obligations).

- This is because the cost of debt is lower than the cost of equity – so the return on equity is better.

- The debt to asset ratio is an important indicator as it throws light upon health of the company finances with regard to the risk profile.

- When revenues are high, the company can easily amplify its profits, but when the revenue is low, this high leverage may lead to a strain on the company’s financials.

How Can the Debt-to-Equity Ratio Be Used to Measure a Company’s Risk?

But a D/E ratio above 2.0 — i.e., more than $2 of debt for every dollar of equity — could be a red flag. Again, context is everything and the D/E ratio is only one indicator of a company’s health. Investors who want to take a more hands-on approach to investing, choosing individual stocks, may take a look at the debt-to-equity ratio to help determine whether a company is a risky bet. Banks and other lenders keep tabs on what healthy debt-to-equity ratios look like in a given industry. A debt-to-equity ratio that seems too high, especially compared to a company’s peers, might signal to potential lenders that the company isn’t in a good position to repay the debt. The interest rates on business loans can be relatively low, and are tax deductible.

What is considered a good debt-to-equity ratio?

Of note, there is no “ideal” D/E ratio, though investors generally like it to be below about 2. On the other hand, a comparatively low D/E ratio may indicate that the company is not taking full advantage of the growth that can be accessed via debt. Simply put, the higher the D/E ratio, the more a company relies on debt to sustain itself. Liabilities are items or money the company owes, such as mortgages, loans, etc. For the remainder of the forecast, the short-term debt will grow by $2m each year, while the long-term debt will grow by $5m. Finally, the debt-to-equity ratio does not take into account when a debt is due.

This proves that the business has financed itself without needing to borrow. But it can also show investors that business owners aren’t realising their company’s full potential because they’re not borrowing to grow. A debt-to-equity ratio of 0.5 means a company relies twice as much on equity to drive growth than it does on debt, and that investors, therefore, own two-thirds of the company’s assets. Investors and banks tend to prefer companies with debt-to-equity ratios of less than 1 because there is less risk in investing in companies that have fewer financial responsibilities to creditors.

As a result, drawing conclusions purely based on historical debt ratios without taking into account future predictions may mislead analysts. If a company has a D/E ratio of 5, but the industry average is 7, this may not be an indicator of poor corporate management or economic risk. There also are many other metrics used in corporate accounting and financial analysis used as indicators of financial health that should be studied alongside the D/E ratio. A company’s how to create a management report in xero management will, therefore, try to aim for a debt load that is compatible with a favorable D/E ratio in order to function without worrying about defaulting on its bonds or loans. The debt-to-equity ratio is an essential tool for understanding a company’s financial stability and risk profile. By analyzing this ratio, stakeholders can make more informed decisions regarding investments and lending, ultimately contributing to better financial outcomes.

Since debt financing also requires debt servicing or regular interest payments, debt can be a far more expensive form of financing than equity financing. Companies leveraging large amounts of debt might not be able to make the payments. While the total debt to total assets ratio includes all debts, the long-term debt to assets ratio only takes into account long-term debts.

Generally, a D/E ratio of more than 1.0 suggests that a company has more debt than assets, while a D/E ratio of less than 1.0 means that a company has more assets than debt. Debt financing is often seen as less risky than equity financing because the company does not have to give up any ownership stake. A low D/E ratio shows a lower amount of financing by debt from lenders compared to the funding by equity from shareholders. The nature of the baking business is to take customer deposits, which are liabilities, on the company’s balance sheet. However, in this situation, the company is not putting all that cash to work. Investors may become dissatisfied with the lack of investment or they may demand a share of that cash in the form of dividend payments.