Selecting the right standard bank produces a huge difference into the managing your money. Will, that it begins by the going for which type of institution, such as for example a cards union otherwise financial. At a glance, it elizabeth. However, you’ll find trick differences between both that you need to getting alert to. However they are borrowing unions better than banking companies? Keep reading to determine.

What are the parallels between borrowing from the bank unions and you will finance companies?

You to crucial material this type of financial institutions have commonly are shelter. They are both federally insured. Borrowing from the bank unions is actually insured because of the Federal Borrowing from the bank Union Management (NCUA), while banking companies is actually covered by the latest Government Put Insurance rates Company (FDIC). Both NCUA and you will FDIC supply the same amount of coverage and can guarantee your own deposits up to $250,000. Very, in the event that an establishment goes wrong, you’ll be able to arrive at minimum $250,000 of cash back. There is no doubt it doesn’t matter if you choose a card commitment or a financial.

In addition, borrowing from the bank unions and you may finance companies both provide similar functions such as savings and you can examining profile, on the internet and cellular financial, domestic and you may auto loans, team characteristics, debit cards etc. However they offer perks and you may rewards on the account holders.

Which are the big distinctions?

The biggest difference in credit unions and you may banks is the fact borrowing from the bank unions aren’t-for-earnings entities which can be representative-had when you’re financial institutions was to have-money and you may owned by people. This may make a significant difference into the cost and charge (regarding which when you look at the a while).

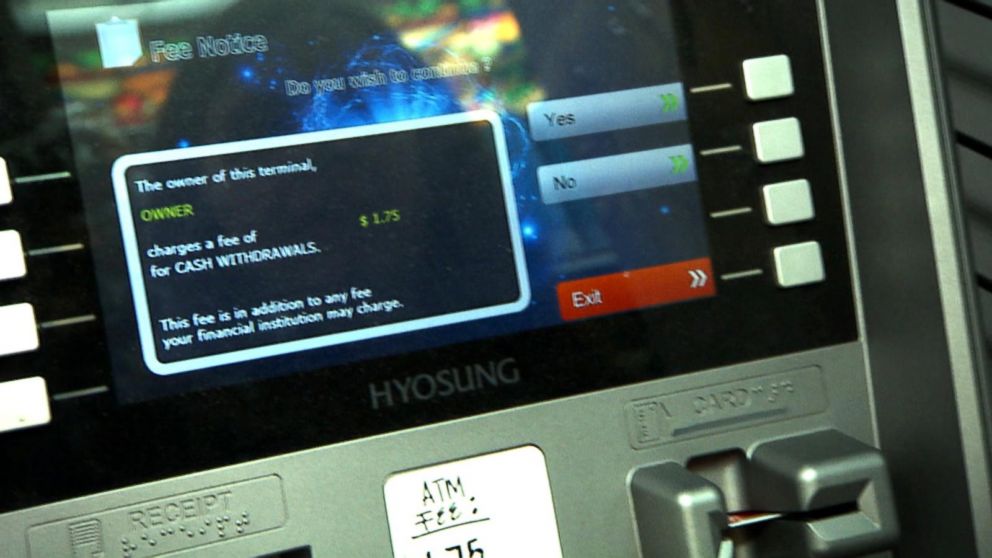

Large, local otherwise federal banks tend to have significantly more urban centers and you can ATMs than just credit unions. This can create financial institutions far more convenient for people who travelling a great deal or are now living in numerous urban centers. Borrowing unions, on the other hand, usually are section of a beneficial surcharge-totally free Atm network, to help you still end extremely charges.

A special improvement? When you’re borrowing from the bank unions generally speaking need you to be a part inside order to make use of the features, financial institutions dont. not, the brand new criteria to join a card connection are usually large sufficient to include a lot of people, so it’s quite simple in order to become a part and you will enjoy this new benefits associated with banking having a credit commitment.

Exactly why are borrowing unions a lot better than banking companies?

Since they are exclusively founded, borrowing from the bank unions bring numerous pros over banking institutions, leading them to a much better economic choice for people. Listed below are four reason credit unions are better than banks:

1. Credit unions aren’t-for-money and you can member-possessed

We now have already highlighted which, but it surely was at this new key out of why credit unions try one step significantly more than financial institutions. Banking institutions is actually belonging to traders with the goal of flipping a good finances via users-that is, accountholders, consumers and so on. That it will contributes to large will cost you on buyers.

On the contrary, credit unions is actually owned by members (members, individuals and the like), maybe not dealers. This means all the winnings attained from the borrowing unions was gone back to participants in the way of better cost and lower charge And some of the attributes incorporate zero charges anyway. https://paydayloanalabama.com/albertville/ Actually, of many borrowing from the bank unions still create users to include a bank checking account for free and do not need at least harmony.

2. Credit unions enable it to be players getting the say

Borrowing partnership members can choose so you’re able to choose board members to show them and help build very important decisions in regards to the proper assistance out of the college. Members features a declare because they are part residents, not just customers.

step three. Credit unions invest in town

Due to the fact borrowing from the bank unions won’t need to love spending stockholders, tips and you can money is going to be provided to great grounds, specifically those near to family. Borrowing unions help all kinds of regional, local and federal organizations and you can mentor several community situations.

For example, Solarity Borrowing from the bank Relationship prides alone into helping the Yakima town and the newest Pacific Northwest. For example donating, producing and you will integrating which have houses efforts, hospitals, schools, gentle communities, causes and teams which can be operating for the confident transform.

Investing the city also contains delivering economic training and you may info. Borrowing unions can offer financial counseling and you will lessons to make certain that members produces better, smarter decisions.

4. Credit unions be more obtainable, flexible and accommodating of the members’ demands

Borrowing unions give checking and you will discounts profile which have reduced or no lowest harmony conditions. Remaining the absolute minimum harmony inside the a merchant account shall be stressful, especially when you’re going by way of financial hardship, and some banks charge fees in the event your equilibrium is just too lowest. In the event that a credit union does have lowest balance criteria, this is usually a decreased, a great deal more in check amount. And at many borrowing unions, checking and you will savings levels was totally free.

You might be including very likely to get approved for a financial loan as a consequence of a card connection. Or even fulfill what’s needed, guarantee isn’t really forgotten. Borrowing from the bank unions could be more flexible regarding the specific things, such as your credit rating or settlement costs. The thing to remember is the fact borrowing from the bank unions wanted users so you’re able to get money and you may reach their financial goals.

5. Significantly more custom provider and a better connection complete

Including providing members a vocals, credit unions also have a more communal environment. Whatsoever, borrowing unions are part of your local society. He is staffed by area people just who see the local discount and housing industry.

The less proportions does mean you earn adequate focus. Borrowing from the bank unions was affiliate-based. They give higher customer service into the your own level. The employees are more likely to know your term after you stop in.

Borrowing from the bank unions provides team who’ll listen to their tale, give alternatives and offer pointers. By comparison, you won’t find with financial institutions. The regulations are often rigorous and inflexible. They won’t make sure to consider your unique problem.

Work at a cards Commitment

There are many reasons why borrowing from the bank unions can be better than financial institutions. And will also be able to find many of these rewards while also once you understand you’ve got the same membership choices, benefits and you may amount of cover since the a bank. Today, it’s just a question of finding the optimum borrowing commitment having you.

While in the Pacific Northwest, sign-up Solarity when planning on taking benefit of most of the credit union professionals. Discover additional information about applying for Solarity Borrowing from the bank Relationship with the our very own site. We have made it easy, too. It takes only a couple of minutes to apply on the internet. Thus, what exactly are you awaiting? Already been possess borrowing commitment difference for your self!

Our pro Financial Instructions are here to assist

There’s nothing our home Mortgage Books like more watching participants move into the dream belongings. We’re right here to keep some thing as facile as it is possible (also a fully on the internet yet , customized processes)!