There have been two essential procedures lenders used to pick if otherwise maybe not a citizen is also be eligible for a house equity mortgage, second home loan or personal line of credit. Basic, it look at the homeowner’s latest monetary visualize.

Loan providers can certainly and effortlessly check a beneficial homeowner’s creditworthiness. not, there are of a lot opportunities to improve on drive-by assets appraisals, that can be used for non-GSE fund lower than $400,000, instance home collateral loans, lines of credit and refinances.

The most known drawback regarding drive-by valuations is that they renders presumptions concerning the inside of a house, that can bring about improved exposure otherwise less chance for one another lenders and you may people. By way of example, a drive-from the assessment otherwise review will get overvalue a property where in actuality the interior enjoys signs of wear and tear beyond what might be likely on home’s decades. At the same time, property that has been meticulously was able and you may upgraded of the the owners shall be undervalued. Anyway, a surface-just possessions updates report cannot usually bring adequate belief and certainly will trigger a negative customer feel

The fresh new valuation innovation

Technology is having an adaptive influence on valuations guiding solutions which do not need an enthusiastic appraiser or studies collector to go into the interior of a house otherwise visit the assets whatsoever. This type of the brand new development might help facilitate the latest valuation techniques, reduce origination can cost you, remove threats and increase valuation accuracy.

Choice are in reality readily available that can assess a house on level playing with consistent assessment studies (UAD) criteria. These tools can quickly and rationally choose all round status and top-notch property which aren’t constantly accepted within the drive-by valuations.

Wise desktop sight technology or smart visualize recognition are widely used to build these kind of valuation possibilities. That have computer eyes, the clear answer is trained to pull advice of graphic sources, right after which capture procedures according to research by the information. This technology is already being used in the entire valuation procedure, including to have data range, report-strengthening and you can quality-control.

Regarding the analysis collection process, computers vision opportunities proactively and immediately title and you may verify pictures and you can pull possessions has away from men and women pictures. The technology may also choose damage otherwise solutions to be certain these were treated from inside the an appraisal otherwise valuation report.

To have appraisal otherwise valuation declaration development, computers vision is also pick a topic property’s construction layout, position and you will quality in order to speed new comparables-solutions processes. In lieu of being required to sift through pictures out-of a share out-of equivalent conversion process, desktop eyes immediately refers to provides which may be sorted and you can filtered to notably automate the process, while maintaining objectivity and you can credibility on the study.

As well as in new QA techniques, desktop eyes twice monitors the new property’s quality and reputation, validates all right images was in fact taken, support on the reconciliation away from associated has and much more

Examine ?

Confirm, a separate services provided by Freeze Home loan Technical, utilizes pc sight tech, together with other smart research and statistics have, to assist do transparent, credible, goal and credible valuations for the majority financing use times, as well as home security fund, personal lines of credit and refinances.

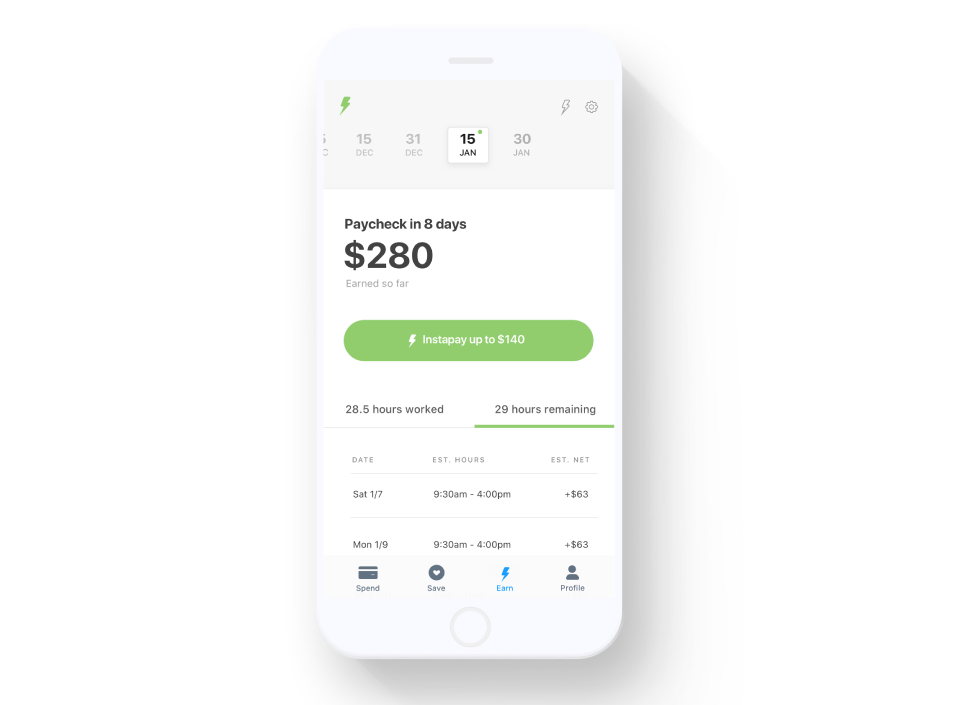

The new borrower have access to Confirm due to a contact otherwise text message link delivered by the financial otherwise in direct the mortgage app. Adopting the a number of effortless prompts, the debtor requires specific photos of its house within the a secure and you may controlled processes, in which only the cam to their equipment is also gather the knowledge. The latest accumulated info is tracked and you can recorded utilising the place characteristics on borrower’s smart phone. It whole process requires a shorter time to complete compared to borrower finding and you can posting their financial documents for their loan application.

Immediately after evaluating the latest property’s position and payday loans Redstone top quality, Verify measures up they with similar home to manufacture a condition-adjusted worth guess. Home equity is calculated from the subtracting any a good home loan liens, just like the understood in the ICE’s public record information research. As well as distribution actual-big date possessions photographs, the citizen finishes a primary questionnaire one verifies societal list investigation.

The brand new homeowner is even capable report about one property-value-boosting features and you will required solutions. Loan providers located show thanks to an integrated API otherwise a concise PDF declaration. The lender can choose to make use of Validate’s automated valuation model (AVM) while the a separate valuation or ticket the content range on their traditional valuation-services supplier for additional research.

Removing subjectivity

Ten more appraisers you can expect to offer a house ten various other valuations. Of the leverage tech for the task, we are boosting studies structure when you find yourself assisting to promote a reputable, objective and you may legitimate value of. And what currently requires days or lengthened playing with old-fashioned steps, Validate is deliver just a few minutes.

John Holbrook, Vice-president, Electronic Valuation Options at the Frost Fixed-income & Data Qualities has actually over twenty eight years of experience in security exposure and you may valuation, with kept certain roles due to the fact an enthusiastic appraiser, USPAP teacher and proper opportunities from the LPS, Federal national mortgage association, Guarantee Analytics and you can Black Knight.