If you’re making an application for financing when you find yourself unemployed, feel even more careful on what you put onto the http://paydayloansconnecticut.com/essex-village/ loan application, just what financial you decide on, and exactly how your take control of your cash.

step one. List all types of money on your own application for the loan

You will possibly not features consistent paychecks at the moment, but when you have earnings costing most of the, make sure you become it on the loan application; it can improve chances of approval.

2. Thought an associate-go out business or self-employed performs

If you are not introducing far bucks, envision taking up a member-time employment otherwise front hustle and also make more income one which just apply for the loan. Apps such Uber, Lyft, Prefer, and Shipt every give entry-level area-time gigs, and you may Upwork and you will Fiverr can be helpful programs to get freelancing opportunities.

step three. Remain on finest out of charge card payments or any other loans

Lenders usually scrutinize your credit rating and you may fee records. If you have fell trailing otherwise defaulted toward most other debts, lenders might be reluctant to agree your for a loan. Make your best effort to pay on time, everytime, having credit cards and other finance, though it indicates simply making the lowest payment.

I would suggest creating automated monthly payments to invest the minimum fee due; this handles you against lost a fees and damaging the credit.

cuatro. Prefer a lender one to plans customers like you

Particular loan providers simply mortgage in order to high-borrowing from the bank consumers, while some have less stringent conditions and so are happy to issue finance to help you individuals with average or even less than perfect credit scores. If your score is found on the lower side, make sure you shop around for your lender. Incorporate which have an industry (including Legitimate), otherwise see a loan provider that objectives reduced-borrowing from the bank consumers to save yourself some time trouble.

5. Incorporate a cosigner otherwise co-candidate to the financing

Applying having good cosigner or a great co-candidate will help replace your test at providing a loan-particularly when he has a steady earnings and you may good credit. Just be sure they are aware what they are joining: They are with the link on the personal debt while you are incapable to settle they.

When you find yourself wanting these types of possibilities, have a look at courses below for additional info on this type of money and you will evaluate businesses that offer all of them:

Should you get a personal bank loan if you’re out of work?

It’s adviseable to check around to suit your loan. Rates, terms, installment episodes, and other details may differ of the bank, and you may comparing the choices can mean severe savings through the years.

Whenever you are happy to shop around and have ways to new inquiries over, check out the top unsecured loans to obtain a choice one to suits you.

I recommend seeing a monetary counselor or a financial top-notch, dependent on what you can afford and you may whether you have got an founded reference to you to definitely. Do not forget the borrowed funds have a specific objective while learn what you will use it to have. Ideally, to date, its to own a would really like rather than a desire.

Choice choices for people with no job

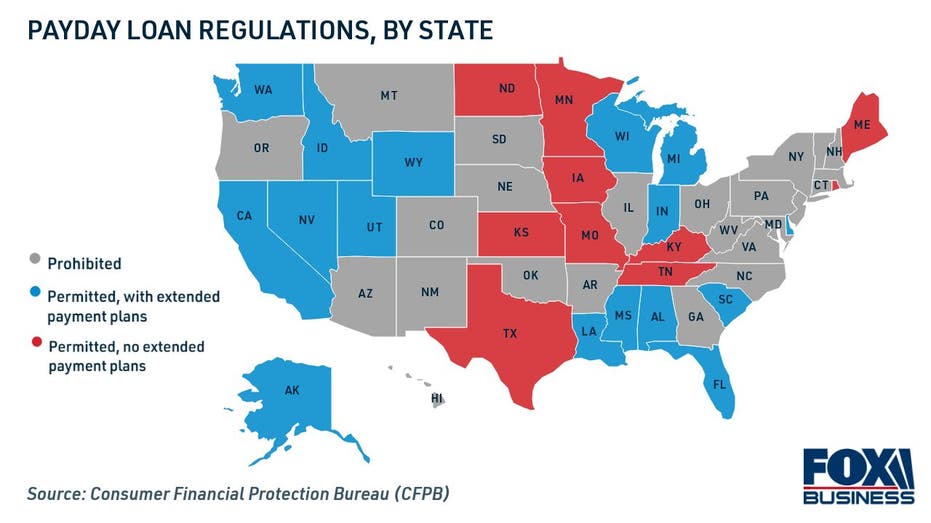

- Payday loan app: Software promote small financing to users predicated on its income and you may expected paycheck. Payday loans software they can be handy within the problems, however they will feature charges, and be required to pay off the advance inside days or on your next pay check.

- Secured loans: A secured unsecured loan try an option when you yourself have specific sorts of guarantee, such as an automible, carries, otherwise team gizmos. Because they are protected of the an asset, they typically come with lower cost and you will big financing amounts than traditional unsecured unsecured loans. The latest disadvantage is that their investment is at exposure if you standard to your loan.