Into the effortless terms, predatory financing is an unfair routine that makes it hard for individuals to repay its financing. Usually, predatory credit pertains to high rates, too much charges, undetectable and undisclosed terms, etcetera. In the example of a mortgage loan, whenever a borrower cannot pay the loan matter, the property is actually foreclosed, or even the borrower could even have to file bankruptcy.

Predatory financing is one of several primary aspects of the economic recession away from 2009. Regrettably, predatory credit means have not prevented ever since then. Hence, you should be a smart individual to quit are a beneficial target off predatory lending.

Talking about a number of predatory lending cues just be alert to when shopping otherwise taking out fully home financing.

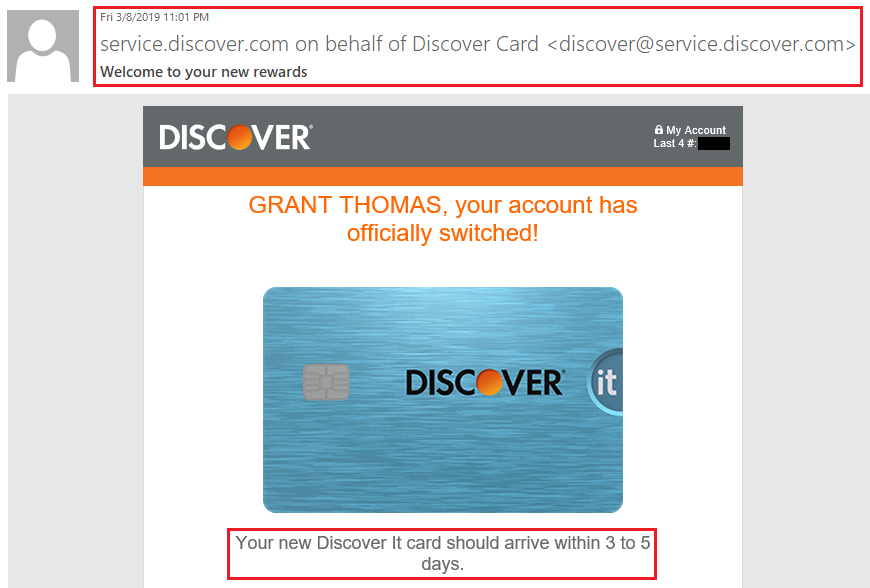

Loan even offers through the send

You can aquire financing also offers over the phone otherwise through the post. However, barely usually these are from legitimate lenders. Very, for individuals who discover a telephone otherwise mail bring, it would be out-of a keen unlicensed bank.

The lending company charge more 3% costs

Usually, you have to pay ‘points’ or ‘discount points’ toward bank when planning on taking aside financing. Although not, it should be contained in this step 3% of your full amount borrowed. Thus, in case your financial is actually charging more, it is a red flag.

The loan boasts a higher level of interest

Stay away from funds that come with higher interest levels, particularly around three-finger rates. That is a yes indication of predatory lending. It can pitfall consumers on a period away from loans, that’s difficult to emerge from.

Complaints contrary to the financial

Just as you research critiques before buying things, check out product reviews concerning your financial just before getting financing. Take a look at on the internet even if the lender possess a happy customer base. Beware if there are countless complaints because it’s indicative from predatory decisions.

The borrowed funds boasts a beneficial prepayment punishment choice

It is preferable not to choose a mortgage loan that have an excellent prepayment punishment. It means you have to pay a fee if you want to settle the loan very early. You will have to shell out so it payment even though you wanted so you can refinance having ideal small print in your financing.

Instance a choice can prevent you against repaying your loan very early, even although you can also be. Because of this, it does reduce the great things about refinancing.

The lending company promises to customize conditions and terms down the road as a consequence of refinancing

Sit aware in case your bank tries to persuade you that future refinancing often solve any issue. This really is a technique of predatory lending to market bad selling in order to individuals. It’s always best to look for financing, compare the newest small print, and you will select the most appropriate the one that you could potentially would easily along side whole mortgage name.

You can make use of mortgage calculators and discover your house loan value. At exactly the same time, abstain from repeated refinancing. You have to pay much more because of the a couple of times altering from just one financing to some other.

The financial will most likely not range from the cost of insurance policies and you can assets fees in your monthly mortgage payments. Below are a few beforehand even though their lending company has established an enthusiastic escrow make up this type of unavoidable costs. An excellent predatory lender may prefer to improve mortgage financially rewarding of the not including such costs into your home loan repayments.

Later on, you are shocked in case your monthly mortgage money increase. Thus, speak to your lender and get any sort of inquiries arrived at the attention before deciding.

Making an incorrect statement in your application for the loan

Do not make untrue comments on your home loan software, it doesn’t matter which indicates you do thus. You must know one giving out wrong details about a home loan software is said to be con. This may are overstating your income, perhaps not exposing your expenses, and the like. You could must deal with criminal punishment.

The financial institution even offers that loan versus checking their creditworthiness

It is a yes indication of predatory credit if they do not look at the creditworthiness in advance of giving you a loan. Loan providers always check your creditworthiness to make sure you’ll be able to to repay the borrowed funds by simply making to the-time loan repayments. A lender may also consult your own lender information getting a handy automatic percentage alternative.

If you agree to it, the lender may end right up utilizing your checking account due to the fact an enthusiastic Automatic teller machine. Create your self a benefit and be of which.

The deal is too best that you become genuine

In the course of time, trust your own intuition when you are taking right out a mortgage and other mortgage. Be mindful in case your conditions and terms into financing are way too advisable that you be correct. Be practical.

Be sure to take a look at fine print very carefully before you could actually choose. You may want to neglect a low profile clause if not realize very carefully. Do not indication anything that you hardly understand.

It is usually better to score help from legal counsel specializing inside the a property legislation. They may be able review the loan contract and you can show you what you might be finalizing.

If you’re unable to afford a lawyer, you could approach a good HUD-recognized guidance company. They’re able to remark your documents and you can send one to an attorney who can make it easier to at no cost otherwise at the an incredibly reasonable pricing. In so doing, might getting confident that you aren’t a victim out-of predatory credit while you are purchasing your dream household.

Bio: Lyle Solomon have significant litigation sense and substantial give-into studies and you will knowledge of court study and writing. As the 2003, they have started a person in the state Bar of Ca. Inside the 1998, he graduated regarding the College of the Pacific’s McGeorge College or university off Legislation in Sacramento, Ca, and then functions as a primary lawyer clickcashadvance.com/loans/mba-loans on the Oak View Laws Group within the Rocklin, Ca.